- Reaction score

- 7,348

- Points

- 1,160

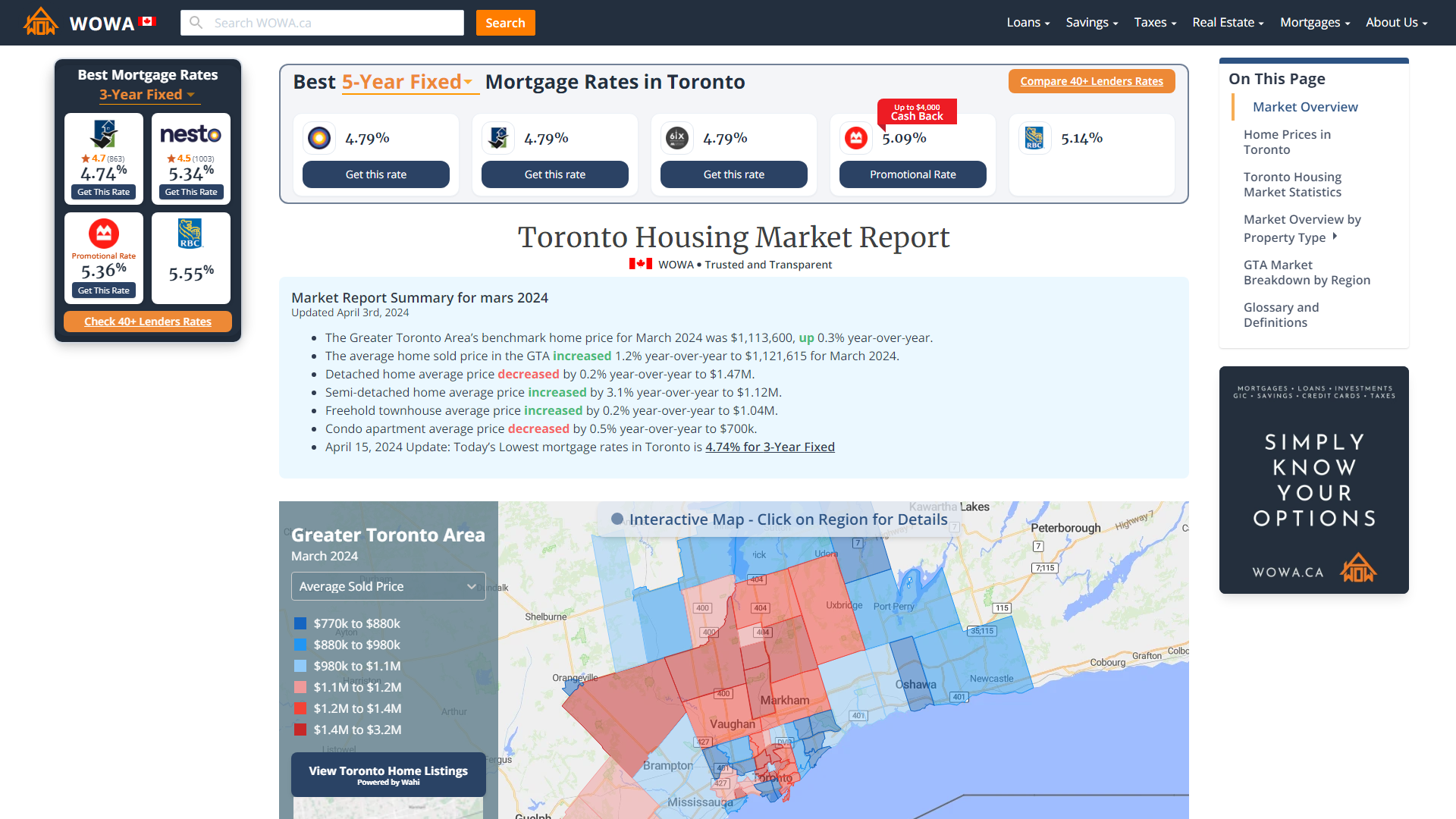

Press accounts in Canada and the UK both indicate that there was a conscious decision to open the doors to more immigrants because the governments feared a downturn in GDP. The immigrants boosted GDP but trashed productivity. The reason for the downturn in GDP was the same governments told the existing population to stay home because of the pandemic. I believe this line of thinking was common across the West. Housing shortages, school shortages, doctor shortages, wage competition, locals staying home and abandoning the labour market are all common complaints. Along with many others.

Except in Sweden.

They have different problems but they decided

a) to ride out the pandemic

b) to ride out the accompanying recession

They are back to "normal" - whatever that means.

Except in Sweden.

They have different problems but they decided

a) to ride out the pandemic

b) to ride out the accompanying recession

They are back to "normal" - whatever that means.