You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cost of housing in Canada

- Thread starter mariomike

- Start date

- Reaction score

- 30,412

- Points

- 1,090

Will no one protect these heritage (checks notes) parking spaces owned by the city and already declared surplus?

Colin Parkinson

Army.ca Myth

- Reaction score

- 13,048

- Points

- 1,160

Looking at the map I see several very large empty lots in the city limits. I suspect residents see a significant local effect that the city does not give a squat about.Will no one protect these heritage (checks notes) parking spaces owned by the city and already declared surplus?

There are very few places for parking in downtown Stoney Creek. Closing even a few of them off could spell the death for any number of businesses there. There is lots of land available out old highway 8 way that could easily accommodate the proposed development. Giving up a parking lot is an easy sell for people who don't go thereLooking at the map I see several very large empty lots in the city limits. I suspect residents see a significant local effect that the city does not give a squat about.

- Reaction score

- 1,704

- Points

- 1,260

World's Best Hospitals 2024

Newsweek has partnered with Statista for its annual ranking of the world's best hospitals, a series that began in March 2019. This year, the list includes data on 2,400 hospitals across 30 countries.

The list includes data on 2,400 hospitals across 30 countries.

Ten from Canada made the list of the top 250 hospitals worldwide, in the following order.

That may, or may not, be important to Canadian home buyers. That is for them to decide.

1. Toronto General Hospital

2. Sunnybrook - Toronto

3. Mount Sinai - Toronto

4. North York General - Toronto

5. Centre hospitalier de l'Universite - Montreal

6. Montreal General Hospital

7. Jewish General Hospital - Montreal

8. St. Michael's Hospital - Toronto

9. Vancouver General Hospital

10. Toronto Western Hospital

- Reaction score

- 7,178

- Points

- 1,360

Totally good decision.....no parking, no business.

The parking spots available is always a red herring the devopers use, unless you know a whole mess of families these days with only one vehicle.

- Reaction score

- 1,704

- Points

- 1,260

March 8, 2024

Saw this in today's news regarding home invasions in Canada.

Rate per 100K people.

https://www.insauga.com/most-dangerous-cities-ranked-in-canada-2-ontario-communities-in-top-10/

Saw this in today's news regarding home invasions in Canada.

Rate per 100K people.

https://www.insauga.com/most-dangerous-cities-ranked-in-canada-2-ontario-communities-in-top-10/

| Rank | Cities | Rate per 100K people |

| 1 | Winnipeg, Manitoba | 811.33 |

| 2 | Lethbridge, Alberta | 763.96 |

| 3 | Saskatoon, Saskatchewan | 761.1 |

| 4 | Regina, Saskatchewan | 733.23 |

| 5 | Kelowna, British Columbia | 708.74 |

| 6 | Moncton, New Brunswick | 607.51 |

| 7 | Edmonton, Alberta | 547.48 |

| 8 | Calgary, Alberta | 518.61 |

| 9 | Windsor, Ontario | 455.84 |

| 10 | Kitchener-Cambridge-Waterloo, Ontario | 438.29 |

| 11 | London, Ontario | 427.42 |

| 12 | Kingston, Ontario | 422.54 |

| 13 | St. John’s, Newfoundland and Labrador | 421.27 |

| 14 | Greater Sudbury, Ontario | 390.21 |

| 15 | Brantford, Ontario | 340.97 |

| 16 | Vancouver, British Columbia | 336.18 |

| 17 | Guelph, Ontario | 334.8 |

| 18 | Thunder Bay, Ontario | 322.86 |

| 19 | Abbotsford-Mission, British Columbia | 298.14 |

| 20 | Peterborough, Ontario | 289.82 |

| 21 | Belleville, Ontario | 287.93 |

| 22 | Halifax, Nova Scotia | 282.61 |

| 23 | St. Catharines-Niagara, Ontario | 279.6 |

| 24 | Victoria, British Columbia | 279.55 |

| 25 | Ottawa-Gatineau, Quebec part | 272.72 |

| 26 | Ottawa-Gatineau, Ontario/Quebec | 258.56 |

| 27 | Ottawa-Gatineau, Ontario part | 254.25 |

| 28 | Hamilton, Ontario | 253.97 |

| 29 | Trois-Rivières, Quebec | 231.76 |

| 30 | Montréal, Quebec | 221.03 |

| 31 | Prince Edward Island | 210.91 |

| 32 | Saguenay, Quebec | 198.44 |

| 33 | Sherbrooke, Quebec | 191.04 |

| 34 | Saint John, New Brunswick | 187.89 |

| 35 | Québec, Quebec | 180.21 |

| 36 | Toronto, Ontario | 162.19 |

| 37 | Barrie, Ontario | 143.16 |

- Reaction score

- 7,366

- Points

- 1,140

NIMBYs win again...

For all the complaints about "strong mayor" powers, they may be the only way to actually push through changes that improve the availability and affordability of housing.

- Reaction score

- 1,704

- Points

- 1,260

I remember about 25 years ago, it was around $400 for a room. But now it can easily be over $1000.

A female could share a room in Etobicoke with three others for $475 ( plus $50.00 for hydro, heating, water and internet ).

Or, have the bedroom to herself for $2,100 per month.

Or, enjoy "prestigious accommodation" in North York with a few other "team players" ( male or female ) for $555. per month.

I know what you are talking about; here, a lot of international students do that. They sleep in bunk beds and share one room with many people so as to keep the rent lower. But the issue is lack of privacy. Also, they probably won't have the space to put desks for 4 people, which they need in order to study.A female could share a room in Etobicoke with three others for $475 ( plus $50.00 for hydro, heating, water and internet ).

Jarnhamar

Army.ca Myth

- Reaction score

- 8,109

- Points

- 1,160

Still lots of room in Toronto, especially on the TTC.

Quirky

Army.ca Veteran

- Reaction score

- 3,993

- Points

- 1,260

Still lots of room in Toronto, especially on the TTC.

lol @ comments. Not wrong.

- Reaction score

- 1,704

- Points

- 1,260

Average home price in Ottawa right now is about 620K.

That's pretty reasonable, ( comparatively speaking, of course ).

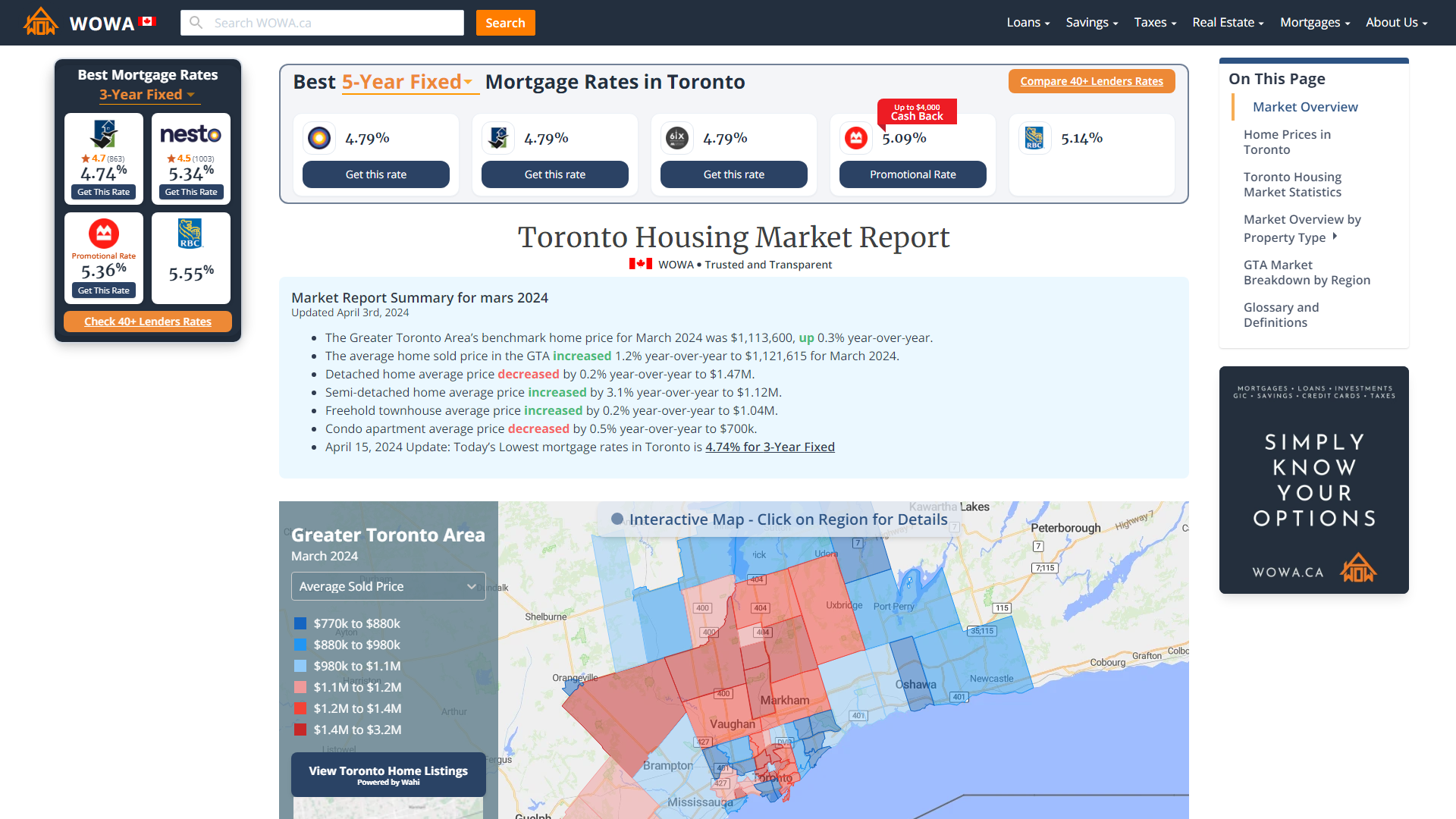

Toronto Housing Market Report

Detached home average price increased by 0.3% year-over-year to $1.44M.

Market Report Summary for February 2024

Updated March 5th, 2024

Toronto Housing Market: Jan. 5th, 2025 Update | Interactive Map - WOWA.ca

The Greater Toronto Area (GTA) housing market ended off an eventful 2024 with a marked decline in average home prices in December 2024, while sales activity has moderated.

Pretty busy NYE at Union Station.

Gardiner was heavy too. Good luck finding parking.

- Reaction score

- 7,206

- Points

- 1,160

I decided in 13 not to go into retirement owing anything outside typical bills like taxes, utilities etc. I paid off my mortgage and was free and clear of any other debt. Best move I ever made. Now I pay cash for almost everything.

Quirky

Army.ca Veteran

- Reaction score

- 3,993

- Points

- 1,260

I decided in 13 not to go into retirement owing anything outside typical bills like taxes, utilities etc. I paid off my mortgage and was free and clear of any other debt. Best move I ever made. Now I pay cash for almost everything.

Ok boomer.

This is the ideal scenario when approaching retirement, however with the cost of living, most Canadians will work forever. At least in the CAF, you can set yourself up (every situation is different) with a pension and equally or more salaried position in the private/public sector without all the shenanigans of being in the CAF.

- Reaction score

- 1,704

- Points

- 1,260

Similar situation in Toronto.Using parking lots for other things seems to be a global trend,City staff say in a new report that Toronto owns 300 parking lots, typically managed by the Toronto Parking Authority, many of which wouldn't be suitable for conversion. However, staff say their examination of those lots shows 130 could potentially support housing.

Turning Parking Lots into Paradise: How Cities Are Creating Spaces For Their People — Europe of Cities

How do the song lyrics by Joni Mitchell go? “They paved paradise and put up a parking lot.” Well, quite the opposite is true in many parts of the world, where cities are dedicating themselves to turning once unused or dilapidated parking lots into paradises of recreation for their people.

Saw something similar at a local park. They permanently closed the main vehicle entrance.

Made parts of the park "car-free" at all times, and reduced it's parking spaces by 60 per cent.

Aper

Member

- Reaction score

- 412

- Points

- 930

This luck or opportunity will never come back for the next generations to come.I decided in 13 not to go into retirement owing anything outside typical bills like taxes, utilities etc. I paid off my mortgage and was free and clear of any other debt. Best move I ever made. Now I pay cash for almost everything.

A typical 3-rooms bedroom home here in Quebec is roughly 550 000$. Add to that a 6% interest rate and a cash-down of 50 000$ for a 30 year period. Monthly costs of your mortgage will be roughy 3 000$, and i'm not even adding all the related costs to this; taxes, utilities, food, gas, and so on.

If housing costs should be around 30% of your monthly income, that means you need to do at least 9 000$ a month before income, or 150 000$ a year, which is not your average Canadian.

Here in Quebec, 60% of the population lives on an income of 50 000$ and less. Only 40% of us are making more than 50 000$/year. This is effing crazy.

- Reaction score

- 1,704

- Points

- 1,260

A typical 3-rooms bedroom home here in Quebec is roughly 550 000$.

That is high.

Even higher in Ontario,

In Feb. 2024, detached houses in Toronto sold for an average of $1.6 million.

How downtown Toronto home prices changed by neighbourhood in February 2024

Compare house and condo sales in The Annex, Core East, Core West, Moore Park, Rosedale and Yonge-St. Clair

Even parking is expensive.

A parking spot for sale in Toronto is listed for almost $200K

What makes this parking spot cost more than some homes in Ontario?

At least in the CAF, you can set yourself up (every situation is different) with a pension and equally or more salaried position in the private/public sector without all the shenanigans of being in the CAF.

If a member can tolerate "the shenanigans of being in the CAF" ( Regular Force ), and some muni employers, for 35 years, s/he can still retire on a 70% pension.

Still under the age of 55 and never having to work again.

An increase from a 2% accural rate to 2.33% would allow members with 30 years of service to GTFO, and still retire at 70%.

Similar threads

- Replies

- 0

- Views

- 10K

- Replies

- 27

- Views

- 30K