- Reaction score

- 4,901

- Points

- 1,160

Could put 4x 50 unit apartments and 3 blocks of duplexes back in there and barely touch the vacant land between the wind tunnel and start of PMQ area. Space isn't an issue, funding and GAFF is.

That’s near the airport, right? Depending on where it is (ie. how it affects the landing/departure pattern) there are height limits, including max height of trees, due to Transport (or NAV) Canada regulations.Could put 4x 50 unit apartments and 3 blocks of duplexes back in there and barely touch the vacant land between the wind tunnel and start of PMQ area. Space isn't an issue, funding and GAFF is.

“It’s time”? Even when I was in high school in the 90s, I was told that a fair percentage of immigrants to Canada from other areas eventually moved to the US.

The thing is there are lots of folks who would proudly say “we moved to [insert country] from Canada and we love it here”. Outside of “anonymous” Reddit threads, I don’t think many would publicly say “we moved to [insert country] from Canada, hate it, and want to (or did) move back” out of embarrassment that they were wrong.

It's closer to the convention center, but there are already some hotels closer to the airport that are 6-8 stories, so it's all relative. Easy enough though to get 50 units in a 6-8 story building without having a huge footprint, and 8 ish units per floor seems pretty common downtown, with more on bigger lots. If you look at hotels they will have 20-30 rooms per floor.That’s near the airport, right? Depending on where it is (ie. how it affects the landing/departure pattern) there are height limits, including max height of trees, due to Transport (or NAV) Canada regulations.

On another forum I follow that is mostly younger urban or urban-centric members there is vocal call for capital gains on primary residences to be taxed (some say at interest level) to unlock the wealth that boomers are hoarding. To many, boomers are the cause of all that is currently wrong. It's more like tax wealth - all wealth - which seems like a fine course of action to those who don't have much.It appears to me that jealousy of someone's wealth is the prime motivation to "tax the rich". Which in other words is Communism.

It might not be as rare as some think. There is still a significant inventory of parents/grandparents summer vacation properties that have yet to be subject to an estate settlement. When you die, every asset is 'deemed sold', and for a cottage bought for a handful of thousands in the fifties that is now worth a million, that's a lot of gain al at once. Some families have planned for it but not all and many have been forced to sell them simply to cover the tax liability, even at 50%.Someone who is offloading enough of an asset at once to realize more than a quarter million dollars in capital gains may be ordinary, but they’re not a ‘poor schmuck’. A capital gains inclusion rate of 2/3 above that first quarter mil is not going to cause hardship.

The most realistic example is someone who owns a non-principal-residence property that has appreciated considerably and who sells. That’s going to be at the bottom end of the wealth intended to be subject to this tax, but it seems to be within the policy intent. The difference would be an additional 16% capital gains inclusion at one’s marginal rate for the gains above $250k. That won’t be hard for the government to sell to most voters who will never be in that fortunate position.

For those relatively rare cases we’ll quickly see various workarounds develop where people will move in to a property for a year before selling, or something like that. The real impact will be felt by those with substantial investment portfolios beyond a single additional residence.

Because I would bet there is a lot of THEIR wealth in offshore accounts.I wonder how the government is doing hunting down all of that money that was off-shored. There was much frowning and 'we take these matters seriously back then.

I suppose they don't grasp that if the rules had been different, people would have spent and saved differently. Whatever I have that might be called "wealth" is just the accumulation of assets because I didn't buy a classic Charger, a sailboat, a motorcycle, a dozen more vacations abroad, etc, etc.On another forum I follow that is mostly younger urban or urban-centric members there is vocal call for capital gains on primary residences to be taxed (some say at interest level) to unlock the wealth that boomers are hoarding. To many, boomers are the cause of all that is currently wrong. It's more like tax wealth - all wealth - which seems like a fine course of action to those who don't have much.

I suppose they don't grasp that if the rules had been different, people would have spent and saved differently. Whatever I have that might be called "wealth" is just the accumulation of assets because I didn't buy a classic Charger, a sailboat, a motorcycle, a dozen more vacations abroad, etc, etc.

…about the same as it’s doing hunting down all of the $15B known overpayments of CERB…I wonder how the government is doing hunting down all of that money that was off-shored. There was much frowning and 'we take these matters seriously back then.

On another forum I follow that is mostly younger urban or urban-centric members there is vocal call for capital gains on primary residences to be taxed (some say at interest level) to unlock the wealth that boomers are hoarding. To many, boomers are the cause of all that is currently wrong. It's more like tax wealth - all wealth - which seems like a fine course of action to those who don't have much.

But does that account for the increased GST generated by the Carbon Tax?You mean the “middle class tax cut” that only reduced the tax burden for above median incomes? The low income earners got nothing from that.

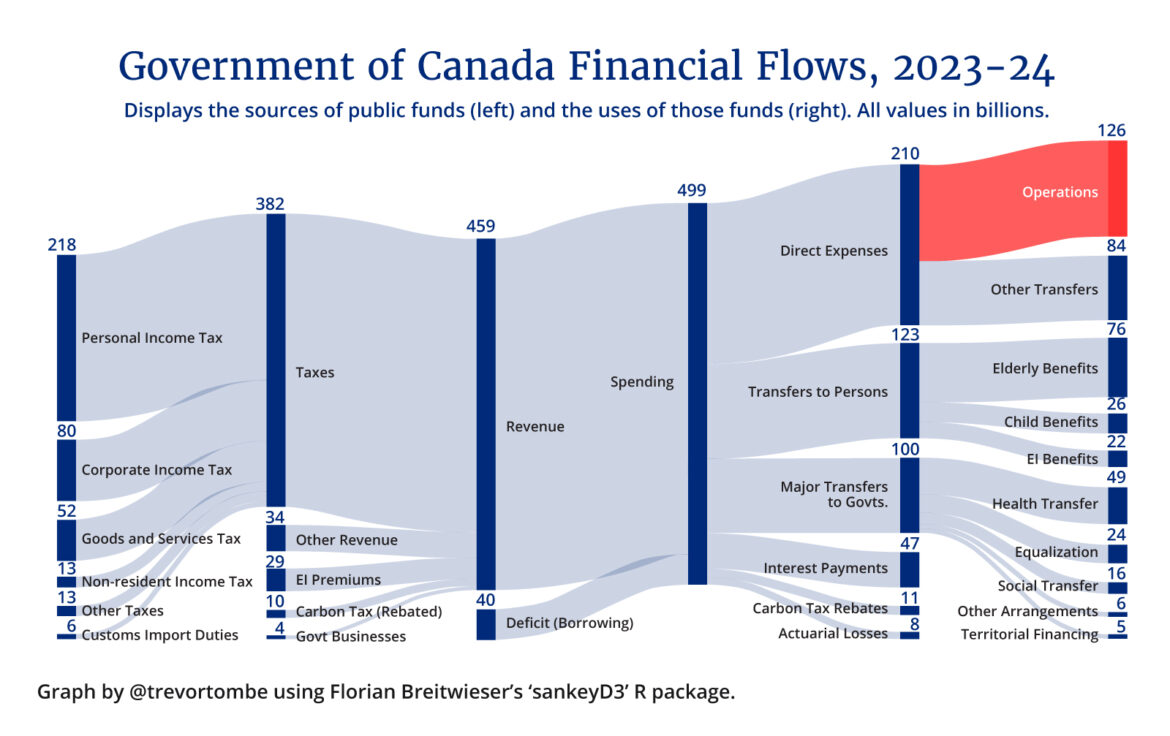

Government cash flows show a different story when you compare carbon tax revenue vs carbon rebate expenditure. It was actually an overall loss last year.

You fuckin did what??? Aghhhhh(It was actually a gently used 74 V8 Barracuda but still... Swapped it for a brand new 78 Celica Hatchback).

Yup. We don't hear much about the Panama papers investigation anymore.I wonder how the government is doing hunting down all of that money that was off-shored. There was much frowning and 'we take these matters seriously back then.

You fuckin did what??? Aghhhhh

I had a 79; one of the most pleasurable and fun to drive cars I ever owned (next to a Miata). As a typical Asian import of the day, though, it ran like a top long after the body disintegrated.Swapped it for a brand new 78 Celica Hatchback).

Chretien, Martin and Mulroney are also listed as Power Players. Perhaps that is part of the reason nobody was prosecuted in Canada.Yup. We don't hear much about the Panama papers investigation anymore.

"Five years after one of the world's biggest leaks of financial records exposed the tax-haven dealings of politicians, athletes, celebrities and mobsters, the Canada Revenue Agency has found missing money in 35 of the hundreds of Canadian cases it has analyzed.

The agency hasn't gotten a single criminal charge filed against anyone as a result of the Panama Papers."

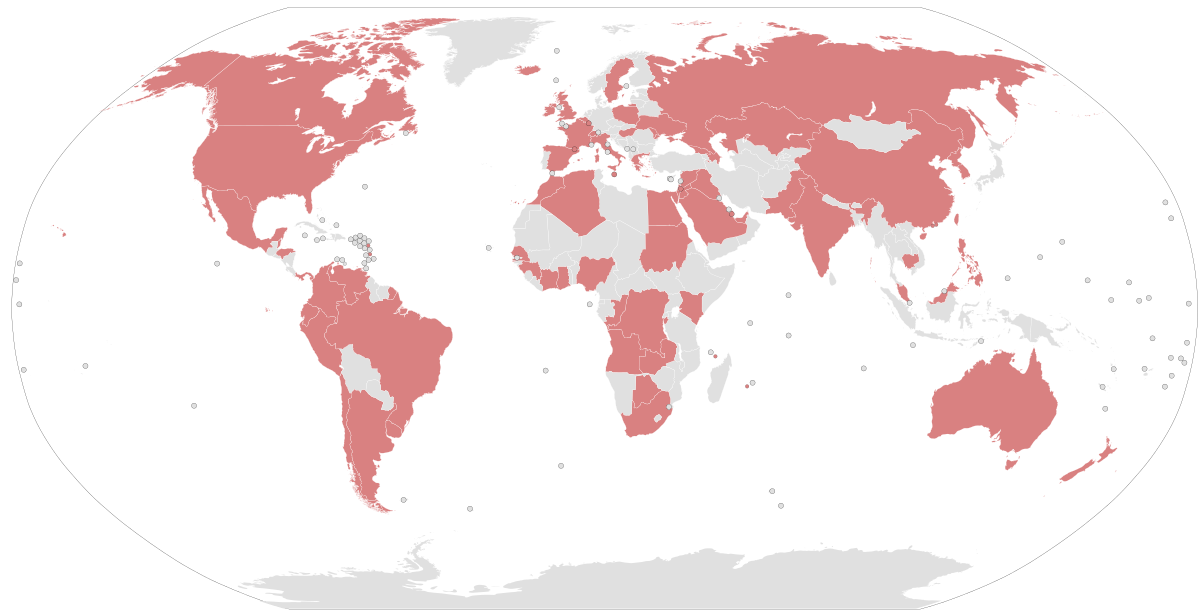

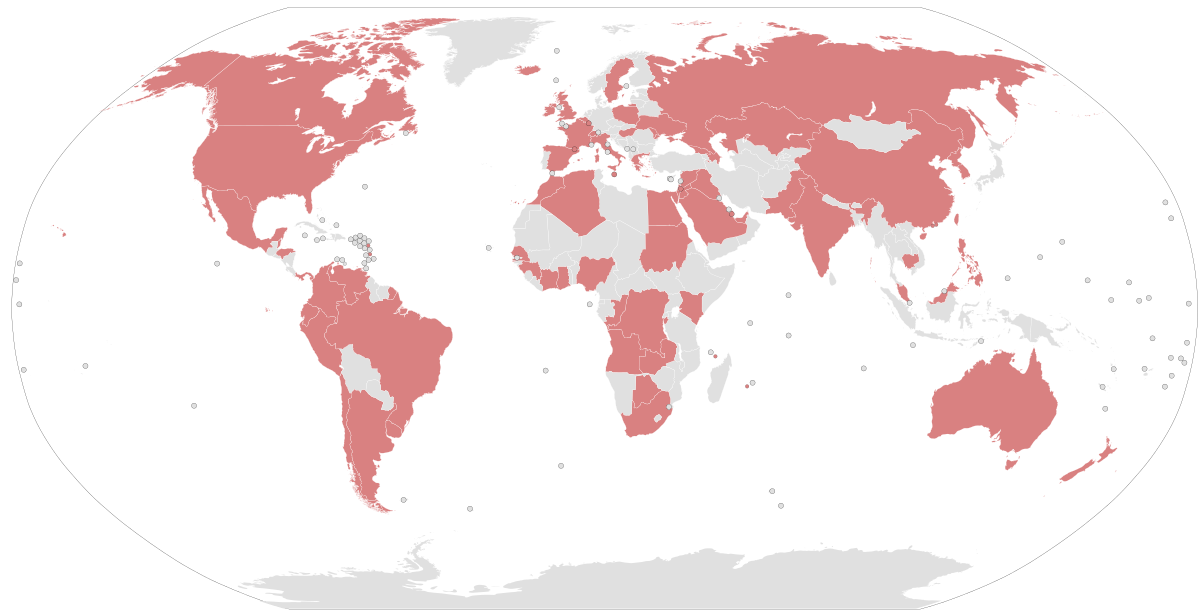

Panama Papers - Wikipedia

en.m.wikipedia.org

A database of the companies and people involved. Zelensky of the Ukraine is listed as a 'Power Player'